Continuously analyze data to understand which interests are resonating with your audience and which ones are not. Use this information to refine your segmentation and content strategy over time.

Request a Demo!

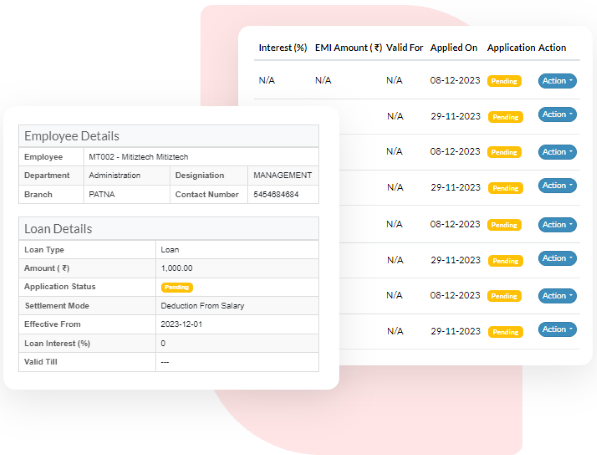

This approach fosters better borrower satisfaction, reduces default risks, and enhances overall loan portfolio management.

Request a Demo!